5 Reasons Why RMC Producers Are Losing Money Today

September 12, 2023

The roaring 20s: A mix of opportunities and risks for RMC producers.

The next few years promise to be an exciting yet challenging time for North American ready-mix concrete (RMC) producers. Producers face razor-thin margins, high liability for quality and service failures, and a market that often fails to adequately price risk and project difficulty.

On the one hand, today’s strong demand is expected to grow, fueled by initiatives like the US Infrastructure Investment and Jobs Act, which will invest $1.5 trillion in infrastructure. By 2028, the North American RMC market will be $235 billion - 1.3 times larger than today. On the other hand, new challenges arise from multiple angles. Material costs are rising; according to CBRE’s Construction Cost Index, construction costs in- creased 14.1 percent in the last year.

14.1% construction cost increase in 2022

At the same time, unforeseen shortages in material supply are further increasing purchase costs. And the gap between increasing demand and the limited pool of skilled laborers is exacerbating the cost challenge for RMC producers. Producers are struggling to find qualified mixer drivers, batchers, and other blue-collar roles, while salary and compensation expectations are skyrocketing. According to the National Ready Mixed Concrete Association, the turnover rate for mixer drivers has increased by 40 percent, with two out of three mixer drivers leaving their current employer for higher pay.

40% increase of turnover rate for mixer drivers

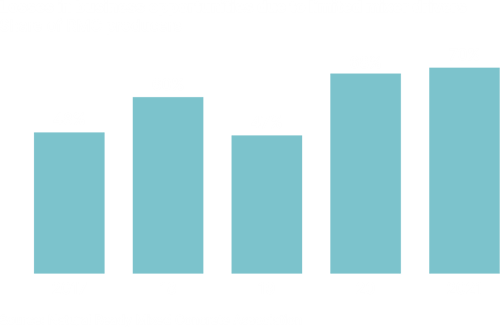

Construction cost drivers and development in 2022

Cost Drivers

Development

Concrete, steel, lumber, energy and equipment are some of the key materials driving costs.

Building size and type are major factors, since the super structure determines the type and amount of primary materials used.

Supply chains, tariffs and other logistical factors play a major role in the cost of materials, especially when demand is high.

Concrete, steel, lumber, energy and equipment are some of the key materials driving costs.

Building size and type are major factors, since the super structure determines the type and amount of primary materials used.

Supply chains, tariffs and other logistical factors play a major role in the cost of materials, especially when demand is high.

Labor costs are the wages and benefits paid to workers turning materials into finished products.

Labor shortages pressure labor costs, either via increased wages to attract more workers or overtime to complete jobs when short staffed.

Labor shortages persisted, deepening wage pressure.

Construction wage growth lagged the national average, leading to higher construction labor costs.

Margins represent the difference between the cost of materials and labor for a project, and the bid price received for it (i.e., profit).

Margins fluctuate heavily based on market demand. Contractors and sub- contractors operate with higher margins when construction jobs are plentiful.

Despite the headwinds, construction demand increased as inflation eased, supported by pent-up demand and govern- ment initiatives.

As contractor backlogs grew, margins increased more significantly in 2022, pushing up costs.

RMC producers have a great opportunity ahead, but mastering operational efficiency and making smart business decisions will be more important than ever. We spoke to hundreds of RMC producers, and some common themes emerged. Here are the top five issues that are seriously hurting RMC producers’ wallets. How are you handling them?

Reason 1:

Inefficient pricing

Inefficient pricing is the number one issue in the market today. Typically, pricing and customer relationships are determined based on volume rather than efficiency. However, not all customers are the same. Material costs are usually known, but the costs of delivery, risk, liability, sales, and customer relationship management often are not adequately quantified. Volume-based bidding that ignores these other aspects leaves producers vulnerable to working with unprofitable clients and diminishes their overall profitability. Moreover, tracking and evaluating service costs for individual customers and market segments has historically been challenging and resulted in a lack of insight into the true efficiency and profitability of each client. Due to the aging and retiring workforce, there are fewer experienced commercial leaders in the marketplace, and less experienced employees need better tools and more stringent authorization protocols to avoid pricing mistakes that rob producers of profitability.

Reason 2:

Poor truck utilization

Poor truck utilization can significantly increase logistics costs for RMC producers. For example, producers may think they need 100 trucks to accommodate a peak delivery time for all customers. However, the costs associated with having enough capacity to make peak deliveries for all customers may not be profitable. It may cost producers hundreds of thousands of dollars a year in fleet-related costs just to make a few customers happy. Unless those customers are the most profitable for the producer, it may not make sense to keep extra fleet vehicles on hand to serve peak delivery periods for the entire client portfolio. RMC producers will find themselves in this situation if they see the following indications:

- Having lower truck utilization rates than their competitors.

- Overservicing the market by having too many trucks and drivers relative to volume, pricing, competition, demand spread, and other market factors.

- Utilizing surge trucks, whether through spot rentals or spare trucks that get deployed during peak times, as opposed to spreading out work to improve demand spread and truck utilization.

- Having too many gaps in the day where trucks are idle, as opposed to managing orders to maximize producer efficiency.

- Letting customers dictate schedule and delivery terms more than what’s profitable and/or more than the market average.

Reason 3:

Suboptimal mix design and recipes

Optimizing material usage, especially for cement, is vital to reduce costs and minimize the environmental footprint of concrete production. Poor mix management can lead to profit leakage and potential liabilities.

This can be attributed to several factors, including:

- A lack of processes to evaluate and optimize cement content based on performance.

- Limited technical understanding of how to manage and improve cement- ing efficiency, which leads to overdesign as a defense mechanism.

- Lack of technical confidence, data, and skills to address low-strength claims.

Moreover, as the industry faces stricter carbon regulations, RMC producers must identify opportunities to lower emissions. Enhancing mix accuracy while reducing cement content is key to achieving these environmental goals.

Reason 4:

Inconsistency in production operating processes

Due to limited value chain visibility, RMC producers often fail to achieve consistent and accurate production, which is crucial to ensuring high-quality concrete. It can be challenging to identify and address inefficiencies within plants, such as batch panel settings, mechanical consistency, and material waste. Without effective monitoring systems, RMC producers can’t make informed decisions and optimize production capacity. As a result, costly errors and suboptimal performance persist, hindering the overall efficiency of production processes.

Reason 5:

Contracts and purchases orders with unfavorable terms

General contractors of all sizes continue to issue RMC subcontracts and purchase orders that are onerous, place increased risk and liability on the supplier, and bind the producer to unfavorable terms and conditions that increase costs and risk. Producers can find themselves chained to high-cost, high- risk, and unprofitable jobs when they don’t have adequate controls in place and the experience to identify, negotiate, and mitigate unfavorable terms.

The way ahead? It’s not rocket science, but data science!

While RMC producers have little control over external market factors, they should aim to be in full control over their businesses’ profitability, now more than ever before. This requires one thing, first and foremost: data.

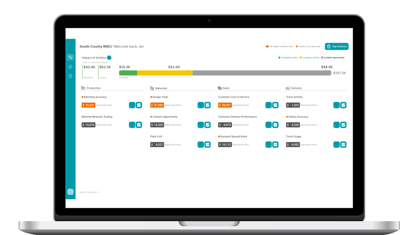

At C60, we’ve been down this road and experienced the same struggles with our partners and clients over the past five years. We are a pioneer in solving these challenges, and we’ve developed a software solution that gives RMC producers a holistic understanding of their company’s operations. Utilizing real-time data from telematics and sensors, we capture and consolidate quantified metrics like batching, quality control, delivery, and cost of service into actionable insights that RMC producers can use for decision-making.To be specific, C60’s unique workflow could identify opportunities in dollar terms and prompt users for the best actions. The tool can be easily deployed in a few hours, requires no additional IT expertise, and can be connected with the most popular RMC software on the market, such as Command Alkon, Marcotte, and JONEL.

C60 is in the business of helping producers drive more profitability. We are the product of decades of experience from our co-inventors, who spent years optimizing the way RMC producers find efficiencies in their businesses. We have applied their experience and know-how in over 30 countries and more than 1,500 concrete plants.

At C60, we’ve assembled a team from the RMC industry that uses soft- ware and analytics to create the first opportunity platform to put dollars back in the pockets of RMC producers.

We’d love to hear from you - contact us today to discuss how to make your business more profitable at sales@c60.ai or +1 (760) 219-8718 or 1 (514) 909-9231.

Up Next

Sign-up to get it directly in your inbox our next white paper with tons of insights for RMC Producers